mymail@mailservice.com

Organize the transfer of assets and protect your spouse at the same time – French tax residents

The split benefit clause

augustus 18, 2022

To protect each other while ultimately passing on their assets to their children, couples often consider joint life insurance that ends upon the death of the surviving spouse.

For such a subscription it is necessary that the invested capital is communal. In France, ownership of the property and its classification as community property depends on the matrimonial property regime of the spouses.

Under the separation of property regime, each spouse is assumed to own their own property. This means that they do not own any common property. For example, money in a bank account in the names of both spouses is considered undivided assets (“bien indivis”). Investing in a joint life insurance policy that ends upon the death of the surviving spouse may therefore lead to a risk of reclassification as an indirect donation by the French tax authorities. Tax is then levied upon the death of the first person to die. Indeed, France has no inheritance tax between spouses, but gift taxes apply to transfers during the lifetime of the deceased and can be up to 45% above 1,805,677 euros.

In any case, it is essential to check whether the couple's matrimonial property regime is appropriate, with the help of a notary who will analyze the spouses' matrimonial property regime[1] and assist them in adapting it if necessary.

Splitting the beneficiary clause can also be an alternative to designate different beneficiaries and plan the successive transfer of assets, while protecting the surviving spouse.

Splitting a beneficiary clause means splitting ownership of the death benefits into two parts:

- The usufruct, which is often transferred to the spouse, is the right to use and enjoy the property. The person who receives it is called the usufructuary or in some cases the quasi-usufructuary.

- Usually, bare ownership is transferred to the children, the right to dispose of the property when the usufruct expires. We call the person who receives it a bare owner.

Simplified case study:

George (61 years old), a British national, is married to Emma under the separation of property regime. They have two children, Kate and Will. The whole family lives in France.

Goals:

- Invest 700,000 euros in UCITS Plan his wealth transfer efficiently and step by step, first to his wife and ultimately to his children

The OneLife solution:

- Wealth France, life insurance contract, with: George as policyholder and insured, A split beneficial clause with Emma as usufructuary and his children as bare owners, An investment in external funds allowing UCITS to be selected.

Fiscale impact

As long as George does not surrender his policy in whole or in part, the chosen solution remains tax neutral for him.

- On the death of George

Since it concerns premiums paid before the 70th birthday of the insured, the regulation of Article 990 I of the French Tax Code (“FTC”) applies: special benefit of 152,500 euros per beneficiary and a fixed tax rate of 20% up to 700,000 euros and 31.25% above that.

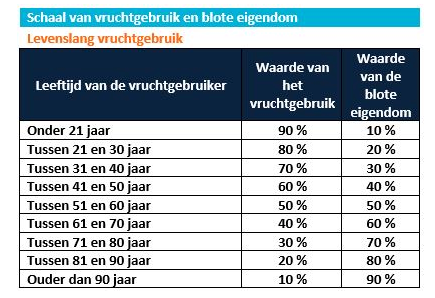

Since the granting of death cover is done by dividing the ownership, a specific scale (Article 669FTC – table below) applies depending on the age of the usufructuary to determine the amounts allocated for tax purposes to the usufructuary and to the bare owners , as well as the part of the compensation.

Assuming that Emma is 68 years old and the contract is worth 1 million euros, the usufruct is 40% and the bare ownership is 60% of the full ownership.

Usufruct: 1,000,000 x 40% = 400,000 euros

Bare ownership: 1,000,000 x 60% = 600,000 euros in total (300,000 euros per child)

Reimbursement per child: 152,500 x 60% = 91,500 euros

- Emma receives the usufruct, i.e. the death cover of 1 million euros. She can use it as she sees fit and is completely exempt from taxes. She decides to reinvest the money in a new policy with the children as beneficiaries for compensation

- The children receive bare ownership. This means that they will not receive a sum of money, but a claim against Emma's estate. They will be taxed at 20% on the bare property value of 300,000 euros each less the compensation of 91,500 euros

Tax per child: 20% x (300,000 – 91,500) = 41,700 euros

In addition, social security contributions apply at a rate of 17.2% on products that are not yet taxed.

- On the death of Emma

The children receive the amount of the claim (ie the death benefits) and no tax is due up to 1 million euros, the amount Emma previously received, while on George's death they paid tax on the bare property value of only 600,000 euros.

[1] Moving abroad can affect marriage.