10-01-2024 - Of the life we dreamed

Dr. Prof. Duchateau

Even before the Vienna Philharmonic has blown out the last notes of the Radetzky march[i] amid the traditional clapping of hands, most predictions about the year that has just begun have to be adjusted. It would really be a surprise if the year 2024 did not have a number of completely unforeseen plot twists built in, as a result of which most scenarios will quickly find their way to the trash.

Why then do economists feel called upon to make themselves the object of ridicule by sending out their elaborate forecasts at the start of each new year, knowing that all that work will soon be buried under ridicule? ?

The reason is simple and the objective is useful: After all, it is crucial to know where the consensus is on the expected evolution of interest rates and corporate profits, the geopolitical situation and raw material and energy prices, to know what is already happening in the share and bond prices have been processed. It is the deviations from this standard case that cause turbulence, shocks and fluctuations in the financial markets.

The expected scenario for 2024 means that, in combination with a strong recovery in growth in the second half of the year and a far-reaching decline in inflation expectations, the central banks in the US and the Eurozone will have sufficient room to implement a substantial decline in policy rates. feed. But the financial markets have been too quick to take their wishes for reality. At the turn of the year, no fewer than 6 interest rate drops (by a quarter of a percent) over the next 12 months were included in the futures prices, the first already expected on March 20. This seems a bit overconfident to us and beyond the pale. On the one hand, neither the Fed nor its loyal follower, the ECB, will be inclined to implement such rabid interest rate cuts over such a short period.

On the one hand, this seems too much like an admission of guilt and compensation for their excess in the past period. On the other hand, this premise is based on a smooth, linear dismantling of the inflation threat in the coming months.

However, this phase-out will follow a bumpy path, littered with interim doubts. Inflation will undoubtedly maintain its downward trend line over a longer period, but that decline threatens to slow down somewhat in the coming months. Average financing costs have not yet reached their peak, services inflation even appears to be picking up somewhat, wage inflation is lagging behind and therefore still reflects too much on the past, while rents (1/3 of core inflation) remain stubbornly high.

However, commodity, food and energy prices have fallen sufficiently to prevent a generalized acceleration of inflation indicators and allow further declines in the second half of 2024. During the first trading days of 2024, the initial optimism was brutally adjusted, with some sharp corrections in stock and bond prices.

However, don't let this fool you: Expectations for 2024 were so high that even the slightest disappointment was bound to cause ripples. The current setup has immediately become much more realistic and therefore makes stock and bond prices less vulnerable than before. Short-term rates will, with a certain probability, decrease substantially.

But the initial scenario, in which the Fed would implement half a dozen cuts (each by a quarter of a percent) from March, has already been significantly adjusted to (at most) four cuts. This is much more true to reality and still more than adequate, but the stock and bond markets had to bring themselves back into line with the adjusted script during the first trading days of 2024 with some downward adjustments.

The high flyers from 2023 immediately received the worst blows. Of course, because it was also these companies that most anticipated an overly optimistic interest rate scenario. Moreover, the substantial stock market increases in 2023 were concentrated around a (too) limited number of growth companies, mainly from the technology sector, without this being accompanied by parallel improvements in their current profit figures.

This leads to tense price/earnings ratios that discharge in the meantime when the immediately available news does not confirm the far-reaching growth expectations.

But give good wine its crown: Such corrections are temporary and mainly offer opportunities to those who want to supplement their positions even further. In addition, the expected financial-economic context with long-term interest rates declining and expected corporate profits (at least from the second half of 2024)are oriented upwards, allowing a broadening of the stock market increases. Companies from sectors with less spectacular growth expectations and shares from the small and medium-sized enterprises segment will also gain interest.

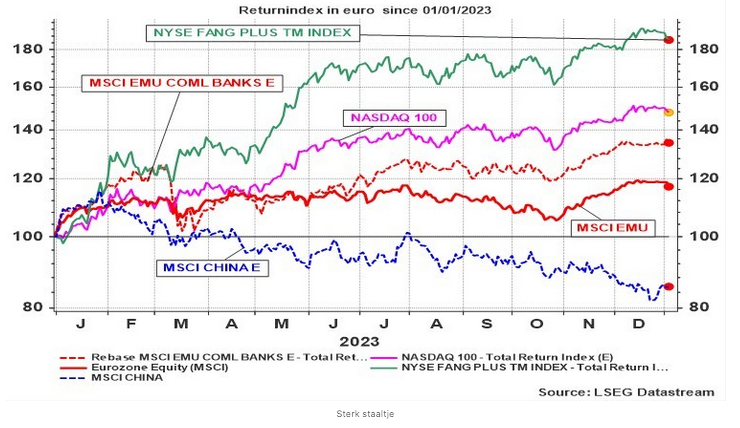

As always, this will be to a limited extent at the expense of the growth-sensitive mega-companies that will make it big again in 2023. The above-average annual performance of this Large Cap Growth segment[ii] has been a dominant investment theme for a decade, alternated very rarely by a better performance of the Value or Small Cap segment. The past year was characterized by strong progress in the world stock index[iii] (+20.2%) with absolute star performances for NASDAQ 100 (+49.9%), S&P500 (+22%) and of course the FANG index (+89.8%).

But the stock performance in the Eurozone also does not look out of place in the 2023 tables. Industrial values rose by 26.3% and the general index rose by 19.7%, mainly driven by the banks in the Eurozone, which rose by an average of 33. 7% - although this writ has a black edge[iv].

China continues to perform poorly, mainly due to the very unfavorable demographic evolution.

Chart 1: Evolution of a number of stock market indices in 2023

Yet these stellar performances mask the large differences in stock market performance between individual stocks, sectors and countries. The increase in this dispersion represents an undeniable trend over the past decade and encourages broad diversification and judicious selection of promising sectors and investment themes. Over the last 5 years, these have unmistakably been the technology sector, especially in robotics, advanced semiconductors, Cloud applications and AI and certain sub-segments of the healthcare sector. Supplemented with companies that closely matched the spending habits of the baby boom generation, these choices resulted in a winning combination.

The European stock market indices also showed large differences between different countries over the past anniversary, with the striking constant being the excellent performance of Denmark and the weak performance of a country where, according to one Julius Caesar, the bravest of the Gauls lived. But apparently that was a long time ago. In 2023, the Brussels stock exchange index[v] was at the tail of the European peloton, just as it has been for the past 3 and 5 years. This year again in the company of permanent partner Finland. An illustration of this is that in the past year, 18 of the 20 largest Belgian listed companies[vi] performed (much) worse than the average performance of the world index. This series of disappointing performances is not the result of a major difference in the sectoral composition of the Belgian stock market indices compared to other European countries, but rather the weak performance of the individual companies within their sector. Belgian representatives in the well-performing European banking, healthcare and industrial sectors scored below par in 2023, a trend that can (with some nuance) be extended to longer periods in the past. It goes without saying that a stock market index is not necessarily the best indicator of the economic performance of a country (and its inhabitants) because many companies are simply not listed on the stock exchange.

However, do not be too quick to use the excuse that Belgium is an SME country and can therefore continue to lag behind on the stock exchange, without this having any signaling value. Belgium has approximately the same number of SME companies as Germany, the Netherlands, France and the UK. The difference lies in the virtual absence of large local companies in Belgium, compared to our neighboring countries. This does not mean that there are no large companies in Belgium. However, these are usually not Belgian and therefore not locally anchored.

The expected scenario in which a further decline in interest rates and a soft landing in the first half of 2024 is combined with a substantial recovery in growth in the second half of the year is attractive for a large proportion of listed securities in the US and Europe. However, a broadening of the stock market rally also entails a (limited) repositioning of the equity portfolio, as a result of which the growth-sensitive companies that delivered excellent performances in 2023 will be exchanged to a (limited) extent for companies that have lagged behind in the past year.

Despite the fact that this may temporarily put some pressure on some of the successful companies in our stock selection, this prospect does not prompt us to make fundamental changes to sectoral choices or the selection of investment themes. Interim setbacks are simply part of life. Life is not the reflection of the life we dreamed of[vii] and it comes down to learning the right lessons from disappointments. And there is no better place to try out these life lessons than in the financial markets, which in the short term are the playthings of the capricious antics of geopolitical leaders but in the longer term generously reward patience.

Or, as Warren Buffett once put it: Financial markets are a mechanism for shifting the money from the impatient people to the patient... There is no fundamental reason to doubt that the positive will prevail in the longer term. To Kurt Vonnegut Jr[viii]. to quote, before this master satirist disappears forever into the folds of history: There is no reason to believe why good should not prevail over evil, (...) insofar as the angels know how to organize themselves as the mafia.

[vii] and it comes down to learning the right lessons from disappointments. And there is no better place to try out these life lessons than in the financial markets, which in the short term are the playthings of the capricious antics of geopolitical leaders but in the longer term generously reward patience. Or, as Warren Buffett once put it: Financial markets are a mechanism for shifting the money from the impatient people to the patient... There is no fundamental reason to doubt that the positive will prevail in the longer term. To Kurt Vonnegut Jr[viii]. to quote, before this master satirist disappears forever into the folds of history: There is no reason to believe why good should not prevail over evil, (...) insofar as the angels know how to organize themselves as the mafia. [i] The traditional closing of the Viennese New Year's concert. What an idea, by the way, to first send out wishes for peace and then use the march that J. Strauss Sr. composed following the victory of the Austrians over the Italian nationalists at the military battle of Custoza. [ii] This segment contains stocks with a market capitalization greater than $10 billion and a price/earnings ratio higher than the median value of the MSCI world index. Small Cap values have a market capitalization lower than $2 billion. Value stocks have a price/earnings ratio that is lower than the median of the MSCI world index. [iii] The stock indices have always been converted into euro terms and take dividend payments into account. [iv] The strong performance of a number of major European banks is related to the increasing financial margin. However, this is largely due to the large difference between market interest rates and deposit fees. [v] We limit ourselves to European stock market indices with a market capitalization greater than €100 billion. [vi] We base this on the general Refinitiv Datastream index for Belgium [vii] After a line of poetry by R. Herreman, which was also the title of a novel by his friend Maurice Roelants. Oh yes, here's a friendly request to the person to whom I lent this book in 1996 to return it to me on occasion. [viii] Kurt Vonnegut Jr. (1922-2007) was a prolific author of plays, essays and novels, including several bestsellers. Slaughterhouse 5 is probably his most famous work, which he wrote based on his experiences as an American prisoner of war during the apocalyptic inferno after the bombing of Dresden in 1945. If you have plans to start a war somewhere in 2024, read this book first.