The office

@Prometheus - Duo-Pro bv

Korte Nieuwstraat 16 - 2000 Antwerp

Contact details :

- Tel: 33 6 65 30 10 95Email: info.duopro@gmail.com or patrick@atprometheus.eu KBO 0.467.025.997Our office communicates with you in Dutch.

The register of insurance intermediaries is maintained by the FSMA, 1000 Brussels, Congresstraat 12-14 and can be found at www.fsma.be.

For all your questions and problems, you can contact our office in the first instance.

Complaints can also be submitted to the Insurance Ombudsman Service at 1000 Brussels, de Meeûssquare 35, tel. 02/547.58.71 – fax. 02/547.59.75 - info@ombudsman.as and www.ombudsman.as.

CUSTOMER PROTECTION

Our services and products offered

Our office is obliged to comply with the “AssurMiFID rules of conduct” and will provide you with the following information in this regard:

Products and services offered

1.1. Information about the concept of insurance mediation

“Our office offers insurance mediation services, i.e. the activities consisting of advising on insurance contracts, offering, proposing, carrying out preparatory work for concluding insurance contracts or concluding insurance contracts, or assisting in the management and implementation thereof.

1.2. Branch numbers and titles

21: Life insurance not linked to investment funds, with the exception of dowry and birth insurance;

22: Dowry and birth insurance, not linked to investment funds;

23: Life, dowry and birth insurance in connection with investment funds;

26: Capitalization operations;

1.3. Policy conditions

For the conditions of the products of our partner companies, please refer to the contact form where you can ask your specific question.

Our compensation

In principle, we receive compensation from the insurance company for our insurance mediation services, which is part of the premium that you pay as a customer. In addition, compensation is possible related to our office's insurance portfolio with the relevant insurance company or for additional tasks performed by our office. For more information contact our office. Otherwise, we receive compensation from you as a customer for our insurance mediation services.

Our conflict of interest policy

1. Legislative framework

The “AssurMiFID rules of conduct” come into effect from April 30, 2014. They find their legal basis in the law of 30 July 2013 to strengthen the protection of customers of financial products and services as well as the powers of the FSMA and various provisions as well as the Royal Decree of 21 February 2014 on the rules for the application of the Articles 27 to 28bis of the law of 2 August 2002 on the supervision of the financial sector and financial services in the insurance sector and Royal Decree of 21 February 2014 on the rules of conduct and rules on the management of conflicts of interest established pursuant to the law, as far as the insurance sector is concerned .

In accordance with these rules of conduct, our firm is required to establish a written policy for the management of conflicts of interest when providing insurance mediation services.

The legal regulation regarding conflicts of interest supplements the general MiFID constitution. This constitution is respected by our office by acting loyally, fairly and professionally for the interests of the customer when providing insurance mediation services.

2. What conflicts of interest?

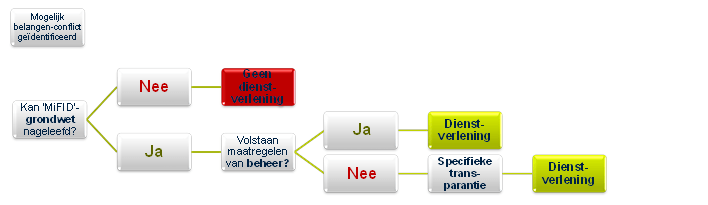

In view of our conflict of interest policy, our office has identified in a first step the possible conflicts of interest in our office.

Conflicts of interest may arise between (1) our office and its associated persons and a client or (2) between multiple clients. The conflict of interest policy takes into account the specific characteristics of our firm and its possible group structure.

When assessing possible conflicts of interest, our office has identified situations where there is a significant risk of harming the client's interests. It's about:

- Situations where a profit is made or a loss is suffered at the expense of the client;

- Situations where our office has a different interest in the result of the service or transaction;

- Situations with a financial incentive to give priority to other clients;

- Situations where the same business is conducted as the client;

- Situations in which our office receives compensation from a person other than the client for the insurance mediation services provided.

- Situations in which our office has participations of at least 10% in voting rights or in the capital of the insurance company(ies);

- Situations in which the insurance company(ies) own(s) participations of at least 10% of the voting rights or of the capital of our office

3. What measures does our office take?

Our office takes many measures to ensure that the customer's interests come first.

This includes:

- An internal instruction note;

- An adapted remuneration policy;

- A policy that ensures that the associated persons only mediate with regard to insurance contracts of which they know the essential characteristics and are able to explain them to the clients;

- A policy that reserves the right of our office to refuse the requested service in the absence of a concrete solution to a specific conflict of interest, for the sole purpose of protecting the client's interests;

- An arrangement regarding the receipt of benefits;

- A policy that ensures that all information provided by our affiliated persons is correct, clear and not misleading.

If necessary, our firm's conflict of interest policy will be adjusted and/or updated.

4. What is the procedure?

5. Specific transparency

If our measures could not provide sufficient guarantee in a specific situation, you will be informed by our office about the general nature and/or sources of the conflict of interest, so that you can make an informed decision. You can always contact us for more information.New paragraph

[1] Act of 30 July 2013 to strengthen the protection of customers of financial products and services as well as the powers of the FSMA and various provisions as well as the Royal Decree of 21 February 2014 on the rules for the application of Articles 27 to 28bis of the law of 2 August 2002 on the supervision of the financial sector and financial services in the insurance sector and RD of 21 February 2014 on the rules of conduct and rules on the management of conflicts of interest established pursuant to the law, as far as the insurance sector is concerned. New paragraph